28+ A simple mortgage calculator

We used the calculator on top the determine the results. The simple mortgage calculator requires only four options that are necessary for any type of loan and mortgage which are the loan amount interest rate loan terms and the starting date.

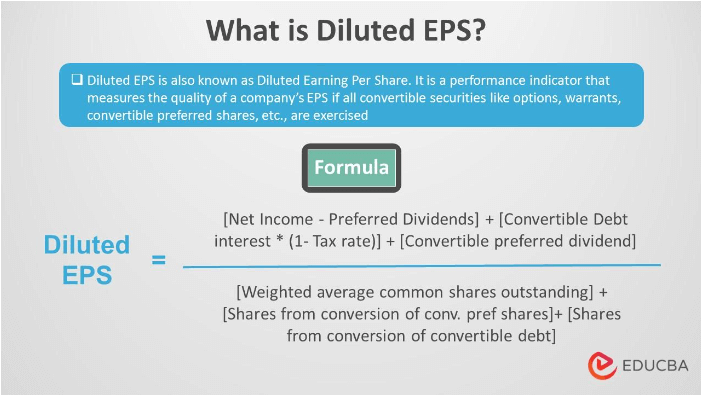

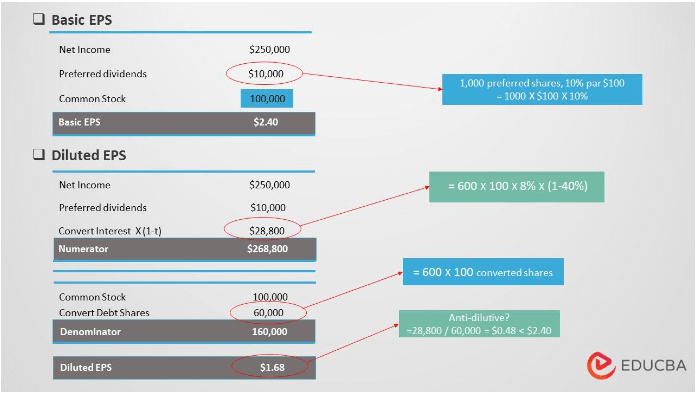

Diluted Eps Earnings Per Share Meaning Formula Examples

Understanding mortgage payment deferral.

. Free Mortgage Calculator Online - Calculate Mortgage Payments With Our Simple Mortgage Rate Calculator Compare The Best Mortgage Offers. Almost any data field on this form may be calculated. Simple Mortgage Calculator PITI Mortgage Calculator.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Across the United States 88 of home buyers finance their purchases with a mortgage. CMHC home renovation financing options.

This calculator shows your monthly payment on a mortgage. Manage your mortgage Mortgage fraud. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format.

Also this is a US mortgage calculator with additional payments some options may not apply to loans for other countries. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. How does debt to income ratio impact affordability.

30-Year Fixed Mortgage Principal Loan Amount. FHA Mortgage Calculator - For those. By making additional monthly payments you will be able to repay your loan much more quickly.

Few homes are built to last 100 years. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Aside from selling the home to pay off the mortgage some borrowers may want to pay off their mortgage earlier to save on interest.

This is a simple calculator that can perform the simple arithmetic tasks - and. You can find this by multiplying your income by 28 then dividing that by 100. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

Use HomeGains Capital Gains Calculator to determine if your gain is tax free or how much capital gains tax is owed from the sale of a property. If we do reduce your monthly payments the term of your mortgage will stay the same and you will pay off your mortgage in the same amount of time. The home loan calculator gives you instant customized results that could have huge implications for your homebuying journey.

The current federal limit on how much profit you can make on the sale of your principal residence that you have held for at least 2 years before you pay capital gains tax is 500000 for a married. Brets mortgageloan amortization schedule calculator. Mortgage rates tend to follow movements of the 10-year United States Treasury.

For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. The simple answer is.

In 2016 the average mortgage term in Sweeden was reported to be 140 years before regulators set a cap at 105 years. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. A mortgage usually includes the following key components.

Years to Pay. This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. Mortgage borrowers with.

Once the user inputs the required information the Mortgage Payoff Calculator will calculate the pertinent data. But like any estimate its based on some rounded numbers and rules of thumb. To show you how this works lets compare two 30-year fixed mortgages with the same variables.

In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. FAQs mortgage loan insurance.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. This home affordability calculator provides a simple answer to the question How much house can I afford. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then.

CMHC mortgage loan insurance costs. Mortgages are how most people are able to own homes in the US. Dont worry you can edit these later.

A good rule of thumb is that your total mortgage should be no more than 28 of your pre-tax monthly income. With links to articles for more information. If you would like to pay off your mortgage sooner than planned please contact us on 0345 30 20 190 Relay UK - 18001 0345 30 20 190.

These are also the basic components of a mortgage. See How Finance Works for the mortgage formula. Historically many financial advisors have suggested adhering to the 2836 rule which says to not spend more than 28 of your gross monthly income on.

The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete amortization schedules. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. Calculate loan payment payoff time balloon interest rate even negative amortizations.

1 to 7 business days. First-time home buyer incentive. To get the most out of the mortgage amortization calculator you can personalize it with your own numbers.

Flexible terms does not require collateral. Download Code Simplecalculator. We are using Else-If statement for performing the functions.

Plan and manage. Guaranteed Rates simple mortgage calculator is such a tool. Use the popular selections weve included to help speed up your calculation a monthly payment at a 5-year fixed interest rate of 5540 amortized over 25 years.

Compound Interest Present Value Return Rate CAGR. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. Our mortgage affordability calculator above can help determine a comfortable mortgage payment for you.

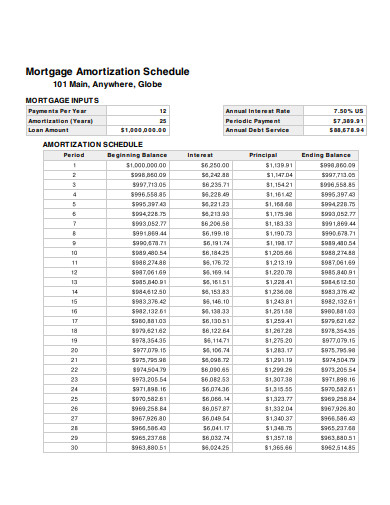

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

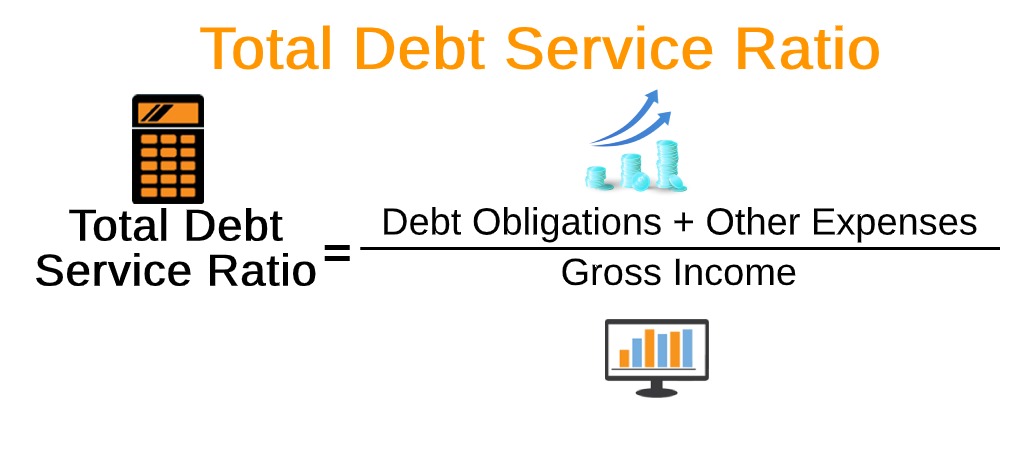

Total Debt Service Ratio Explanation And Examples With Excel Template

Diluted Eps Earnings Per Share Meaning Formula Examples

Payslip Templates 28 Free Printable Excel Word Formats Business Template Templates Professional Templates

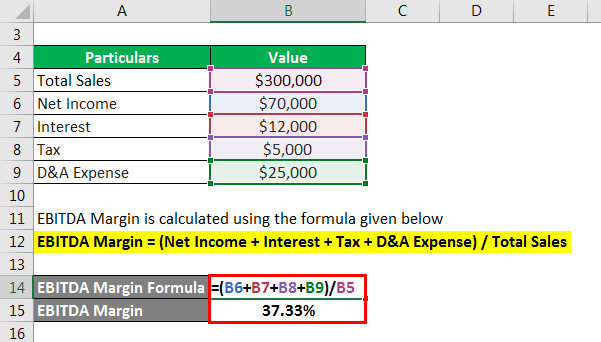

Ebitda Margin Formula Example And Calculator With Excel Template

28 Weekly Timesheet Templates Free Sample Example Format Download Timesheet Template Time Sheet Printable Templates Printable Free

Business Cards For Students Student Business Card Request Survey Student Business Cards Student School Of Education

High School Report Card Template Letter Sample Secondary In High School Student Report Card Temp School Report Card Report Card Template Homeschool High School

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Words

Total Debt Service Ratio Explanation And Examples With Excel Template

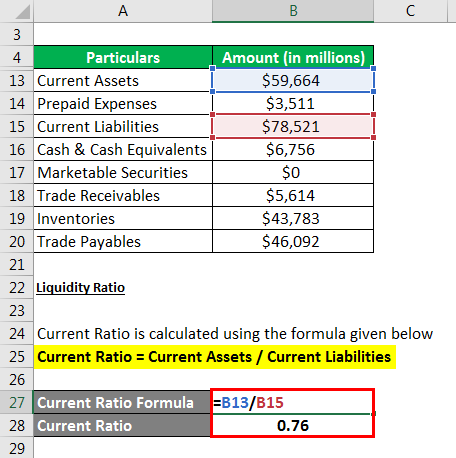

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Product Roadmap Powerpoint Template 9 Powerpoint Powerpoint Design Powerpoint Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

45 Best Startup Budget Templates Free Business Legal Templates

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Repayment

Payslip Templates 28 Free Printable Excel Word Formats Excel Templates Business Template Excel

4 Tier Ladder Bookshelf Storage Display With 2 Drawers Ladder Bookshelf Bookshelf Storage Bookcase Storage