Lump sum compound interest calculator

The secret to saving success is compound interest. R the annual nominal interest rate before compounding.

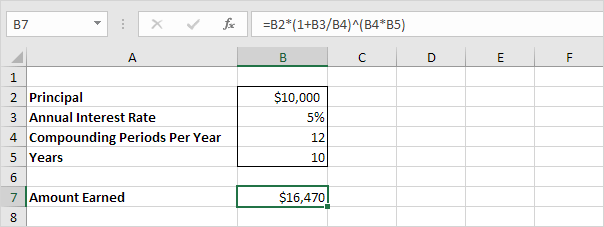

How Do I Calculate Compound Interest Using Excel

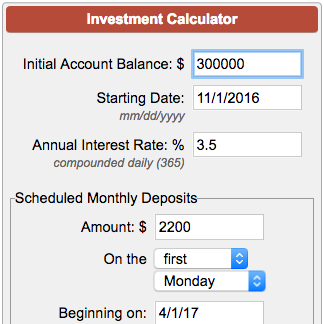

Most bank savings accounts use a daily average balance to compound interest daily and then add the amount to the accounts balance monthly which is.

. Our calculator compounds interest each time money is added. For stock and mutual fund investments you should usually choose Annual. Over the long-term this earns you interest.

Lumpsum calculators use a specific formula to compute the estimated returns on investments. The above calculator automatically does this for you but if you wanted to calculate compound interest manually the formula is. You may also be interested in our monthly savings calculator.

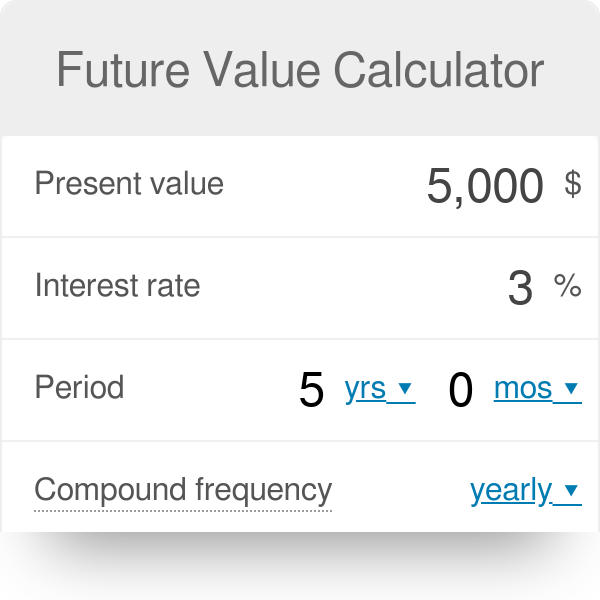

Annual Interest Rate APR. The more frequently this occurs the sooner your accumulated earnings will generate additional earnings. For example youve just deposited 5000 principal at 9 interest compounded annually rate and now you are waiting for it to grow into 10000 total.

Calculate the present value investment for a future value lump sum return based on a constant interest rate per period and compounding. Or in simpler language the lumpsum calculator predicts the future value of your investment that you made today at a particular rate of interest. Technically bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity.

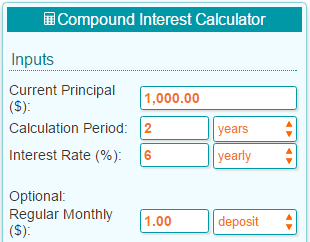

This calculates how your savings will grow over time and the impact of compound interest. In the lump sum calculator you need to enter the amount you are willing to invest expected rate of return per annum you think the investment will generate and the time period in years you are willing to stay invested. A lump sum calculator enables you to calculate the maturity value of your investment.

Conversely investing incrementally each day for a year or each month for 12 months will beat a lump sum invested at the years end. If you have a 500000 portfolio download 13 Retirement Investment Blunders to Avoid. Interest rate variance range.

If you invest 1 lakh rupees for 60 years at 15 rate of interest then according to lumpsum calculator the future value of your investments will be mindboggling 438 cr. The lump sum calculator indicates the future value of your investment made today at a certain rate of interest. Work out interest and investment returns on lump sums and regular monthly saving.

Your Lump Sum Deposit. Ad This guide may help you avoid regret from certain financial decisions with 500000. This calculator allows you to choose the frequency that your investments interest or income is added to your account.

The present value is the total amount that a future amount of money is worth right now. Lumpsum calculators use a specific formula to compute the estimated returns on investments. Fixed rate bonds - a fixed rate of interest for.

Quickly Calculate Compound Interest on Lump Sum Deposits Into High Yield Savings Accounts. If you invest a lump sum every year on January 1st that money will get more time to compound than if you put in 1365th of your investment at the beginning of each day. FV PV 1 rn n t.

P the principal the amount of money you start with. T time in years. In other words the Lumpsum Calculator tells the future value of your investment made today at a certain rate of interest.

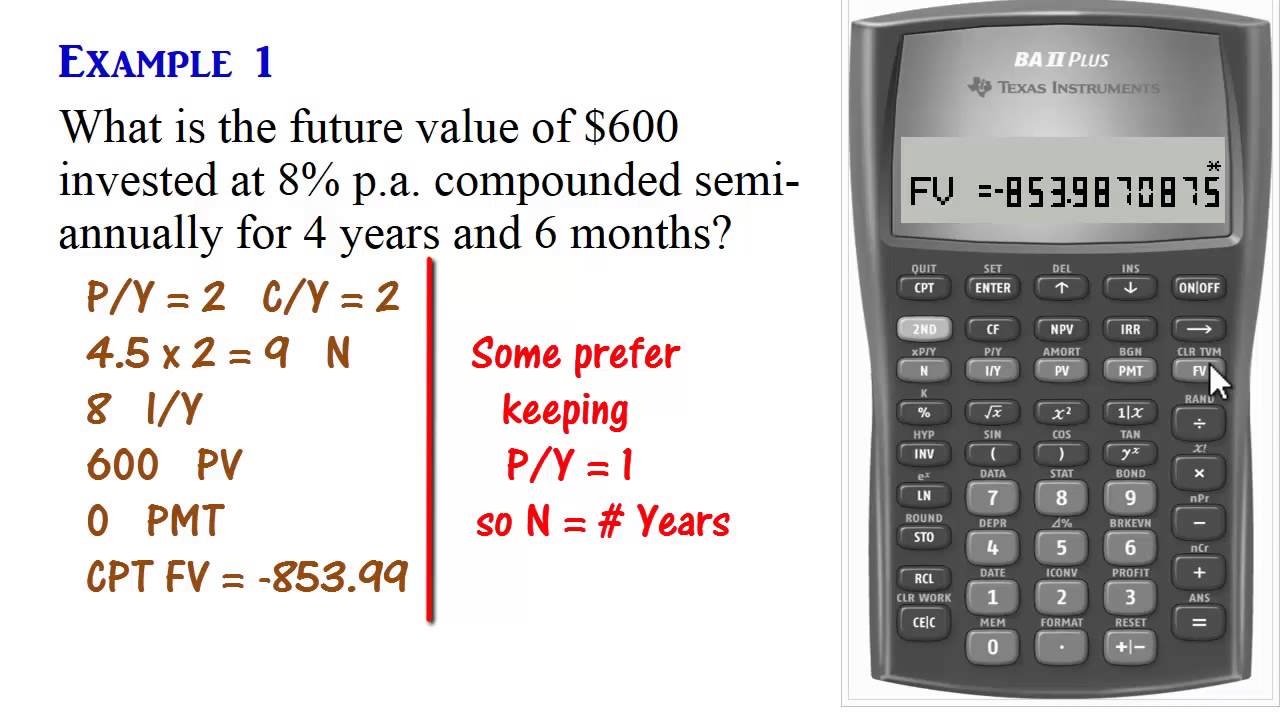

Simply click on the button you dont know input the other 3 numbers then click on the method of compounding to get your answer. If one invests 1 lakh rupees at 15 rate of interest for 60 years then according to the lump sum calculator. This is the amount youve saved or invested so far.

This is a special instance of a present value calculation where payments 0. Your estimated annual interest rate. Use the Compound Interest Calculator to learn more about or do calculations involving compound.

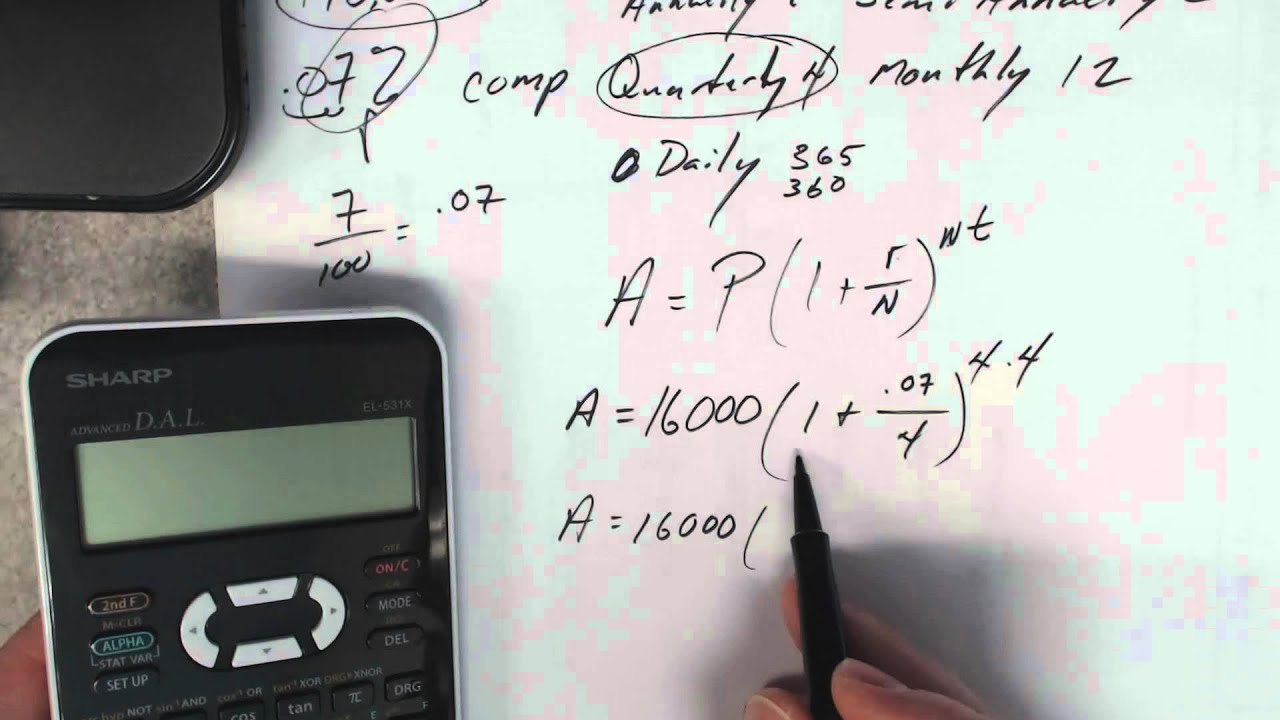

This kind of loan is rarely made except in the form of bonds. Range of interest rates above and below the rate set above that you desire to see results for. A P 1 rn nt.

It is a compound interest formula with one of the variables being the number of times the interest is compounded in a year. Extra added every year. And n the number of compounding periods in each.

The compound interest equation basically adds 1 to the interest rate raises this sum to the total number of compound periods and multiplies the result by the principal. A P 1 rnnt. The formula for calculating expected interest and the maturity value is given below.

The total balance of your ISA and SIPP accounts for example. If the account has a lump-sum initial deposit does not have any monthly deposit by default interest is compounded monthly. The annual cash contributions you.

Here A estimated returns. The compound interest formula solves for the future value of your investment A. The compound interest formula is.

Download all PoF calculators in one. Heres a brief walkthrough for our compound interest calculator including how to dial in an interest rate thats suitable for UK investors. This calculator can solve for any one of these 4 numbers.

Use our lump sum savings calculator to work out how much your savings could be worth in the future. Predetermined Lump Sum Paid at Loan Maturity.

Investment Account Calculator

Excel Investment Calculator Myexcelonline

How To Calculate The Future Value Of A Lump Sum Investment Episode 38 Youtube

Ba Ii Plus Calculator Compound Interest Present Future Values Youtube

Future Value Calculator With Fv Formula

Compound Interest Calculator Getsmarteraboutmoney Ca

Compound Interest Formula In Excel In Easy Steps

Compound Interest Calculator Financeplusinsurance

Compound Interest Calculator Calculate Compound Interest Online Dhan

Compound Interest Calculator With Formula

Compounding Interest Calculator Yearly Monthly Daily

How To Compute Compound Interest In Your Calculator Youtube

Compound Interest Calculator Daily Monthly Quarterly Annual

15k Savings Plan In 2022 Money Saving Methods Money Saving Techniques Money Saving Strategies

Cagr Calculator For Stocks Index Mutual Funds Fd Calculate In 3 Easy Steps Financial Instrument Mutuals Funds Systematic Investment Plan

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Calculator Calculate Compound Interest Online Dhan